User Controls

Buying Crypo

-

2024-03-17 at 2:13 PM UTC

Originally posted by Ghost you are the only one not understanding anything, the rest of the world understands it just fine

Originally posted by Charles Ex Machina WHOA !

vindicktive vinny vindickated again:

https://www.zerohedge.com/crypto/bitcoin-has-no-top-because-fiat-has-no-bottom-understanding-monetary-debasement

-

2024-03-17 at 2:27 PM UTCposting yao faces just proves that you have nothing left, I have destroyed every argument you could ever use. Go ahead and explain how i'm wrong, you will find it difficult to articulate the english words in a logical sentence, you will be unable to complete the sentence without yao faces or insults

that's because you are wrong and you have lost. Just like the banks -

2024-03-19 at 2:14 PM UTC

Originally posted by Ghost posting yao faces just proves that you have nothing left, I have destroyed every argument you could ever use. Go ahead and explain how i'm wrong, you will find it difficult to articulate the english words in a logical sentence, you will be unable to complete the sentence without yao faces or insults

that's because you are wrong and you have lost. Just like the banks

the prices of tulips have no top because fiat have no bottom.

the relationship between one pound of bread to deutschmark in 1924 remains the same as the relationship between a BTC and USD today.

ur just trolling. -

2024-03-19 at 2:16 PM UTCI wonder if Jiggaboo Johnson died.

-

2024-03-19 at 2:21 PM UTC

-

2024-03-19 at 2:26 PM UTC

-

2024-03-19 at 2:31 PM UTC

-

2024-03-19 at 3:14 PM UTC

Originally posted by Charles Ex Machina the prices of tulips have no top because fiat have no bottom.

the relationship between one pound of bread to deutschmark in 1924 remains the same as the relationship between a BTC and USD today.

ur just trolling.

These comparisons have nothing to do with the reality of economy. You are just grabbing media headline buzzwords at this point. 1 BTC will always be worth 1 BTC

the problems you experience are fiat problems, central bank problems, price fixing and government problems. Crypto is immune to all this -

2024-03-19 at 3:31 PM UTC

Originally posted by Ghost 1 BTC will always be worth 1 BTC

nope. worthiness is relative.

its value is derived from how much other tangible stuff we affixt to it so that it can become a MEDIUM OF EXCHANGE.

because thats what a MEDIUM OF EXHCANGE is, a medium to exchange stuffs of relatively equal worth.

like how your asshole was worthless, it didnt even worth an asshole until your dad decided to pimp you out to his fellow drug fiends for drugs and ciggarette money, and your asshole is only worth one asshole when he traded it out to his friend in exchange for the ussage of his friends sons asshole.

an object by itself have no worth. -

2024-03-19 at 3:50 PM UTC

Originally posted by Charles Ex Machina an object by itself have no worth.

Bitcoin isn't an object, it's a computer program

it's value and worth is determined by the work it costs to create 1 "Bitcoin" on the bitcoin network. This is hard coded into the program itself and even if all matter in the universe is destroyed and the only thing is a bitcoin disc solar powered floating through the stars it would continue mining until 21 million bitcoins are produced and there would always ONLY be 21 million

Can you name anything else that exists that there are only 21 million of in the universe? That can't be reproduced? copied? changed?

The only thing I can think of is PoW crypto. It's simply a technological advancement to the medium of exchange model.

Whatever you fail to understand, the banks understand just fine. They are switching to this system and so you will you.The difficulty in scaling

Scaling the Ethereum network is difficult because its current design limits the number of transactions that can be processed per second, leading to high levels of congestion and slow transaction speeds.

Zero-knowledge proof technology can help scale Ethereum by allowing for more efficient and secure verification of transactions without revealing sensitive information. In a traditional blockchain, every node in the network needs to validate and store every transaction, which can lead to slow speeds and high storage requirements as the network grows.

With zero-knowledge proofs, transactions can be verified using a proof that provides sufficient evidence of the validity of the transaction without revealing any private data. This means that transactions can be validated more quickly and with less storage, reducing the burden on the network and enabling it to process more transactions per second.

In the context of Ethereum, zero-knowledge proofs — such as those provided by Starkware’s Prover — can be used to verify the validity of smart contract transactions, enabling the network to scale without sacrificing security or privacy. By reducing the amount of data that needs to be stored and processed, zero-knowledge proofs can help Ethereum to handle a larger number of transactions and support a growing number of decentralized applications.Visa Moving Ahead with Digital Currencies

Although VisaNet can handle up to 65,000 transactions per second, it is still beholden to the Society for Worldwide Interbank Financial Telecommunications (SWIFT) as the baseline payment infrastructure between banks. At the recent StarkWare Sessions 2023 event in Tel Aviv, Visa aims to bridge that gap by experimenting with digital assets.

“We set all over Swift, so we can’t move money as frequently as we’d like because there are a number of limitations that exist in those networks. And so, we’ve been experimenting, we publicly announced. We’ve been testing how to actually accept settlement payments [with stablecoins],”

Cuy Sheffield, Head of Crypto at Visa

StarkWare Sessions is an Ethereum-oriented community event focused on the latest developments, round tables, and workshops. In March 2021, Visa became the first significant payments network to settle USD Coin (USDC) stablecoin settlement on the Ethereum network, thanks to Visa’s partnership with Crypto.com.

Still in the pilot stage, Sheffield said that Visa integrates blockchain transactions on top of the Swift network.

“The same way that we can convert between dollars in euros on a cross-border transaction, we should be able to convert between digital tokenized dollars and traditional dollars.”

For crypto exchanges and other companies, relying on digital assets alone means they don’t have to hold traditional fiat in treasuries for their settlements. For example, Crypto.com uses Anchorage Digital, a federally chartered digital asset bank. As Visa’s partner, Anchorage Digital can settle USDC transactions sent to Visa as a part of the Crypto.com Visa card program. -

2024-03-19 at 4:10 PM UTC

Originally posted by Ghost Bitcoin isn't an object, it's a computer program

non sequeerterit's value and worth is determined by the work it costs to create 1 "Bitcoin" on the bitcoin network.

marketing make belief - ie, fiat.

you can spend 2 million canadian dollar to dig up a giant hole and another 2 million US dollar to fill it back up but that doesnt make that filled up hole worth 4 million in any currency. -

2024-03-19 at 4:13 PM UTCI got 40 different bitcoins in different wallets

-

2024-03-19 at 4:18 PM UTCit's pretty funny you are trying to make the banks argument for them but they don't even agree with you. Everything will be replaced with CBDC just as easy as everyone went from analog to digital

Originally posted by Charles Ex Machina you can spend 2 million canadian dollar to dig up a giant hole and another 2 million US dollar to fill it back up but that doesnt make that filled up hole worth 4 million in any currency.

what?? sounds like a fiat problem to me, I have no idea what your point is here but all I know is that 1 BTC will always be worth 1 BTC and if you understand the true meaning of work and value than you will never worry what "price" bitcoin is at. Buying bitcoin right now is like buying stocks in a technology company it's like buying Amazon or Microsoft stocks in the early 2000s

The Bitcoin network has the potential to be bigger than all global government central bank SWIFT systems combined because it wasn't designed with hebrew central banks in mind, just simple math. You can read the numbers yourself unlike the FED -

2024-03-20 at 1:27 AM UTC

Originally posted by Ghost I have no idea what your point is here but all I know is that 1 BTC will always be worth 1 BTC and if you understand the true meaning of work and value than you will never worry what "price" bitcoin is at.

point being, scrawnny, that no matter how much money, energy and material you put into making something they will have no bearing on its worth.

you can eat a piece of a thousand dollar cake but doesnt mean the shit that comes out of your ass is now going to worth a thousand dollar.

and like ah sed, 'worth' is relative. you need something else to evakhate it comparatively.

saying an oz of gold is worth an oz of gold has no meaning simce it doesnt really state the worth of gold in any meaningful way. -

2024-03-20 at 1:31 AM UTC

Originally posted by Charles Ex Machina

point being, scrawnny, that no matter how much money, energy and material you put into making something they will have no bearing on its worth.

okay? so you're entire point is that nothing is worth anything, wow that's real ground breaking. I don't even care about the energy cost of bitcoin as mining it with solar panels or geothermal would essentially be free

PoW crypto is simply a tokenized unit of work, which can be exchanged. Weather you pay 1 million BTC for a pizza or 1 BTC to an exchange for $100k is up to the market but 1 btc will always be worth 1 btc

-

2024-03-20 at 1:35 AM UTC

Originally posted by Ghost okay? so you're entire point is that nothing is worth anything, wow that's real ground breaking. I don't even care about the energy cost of bitcoin as mining it with solar panels or geothermal would essentially be free

PoW crypto is simply a tokenized unit of work, which can be exchanged. Weather you pay 1 million BTC for a pizza or 1 BTC to an exchange for $100k is up to the market but 1 btc will always be worth 1 btc

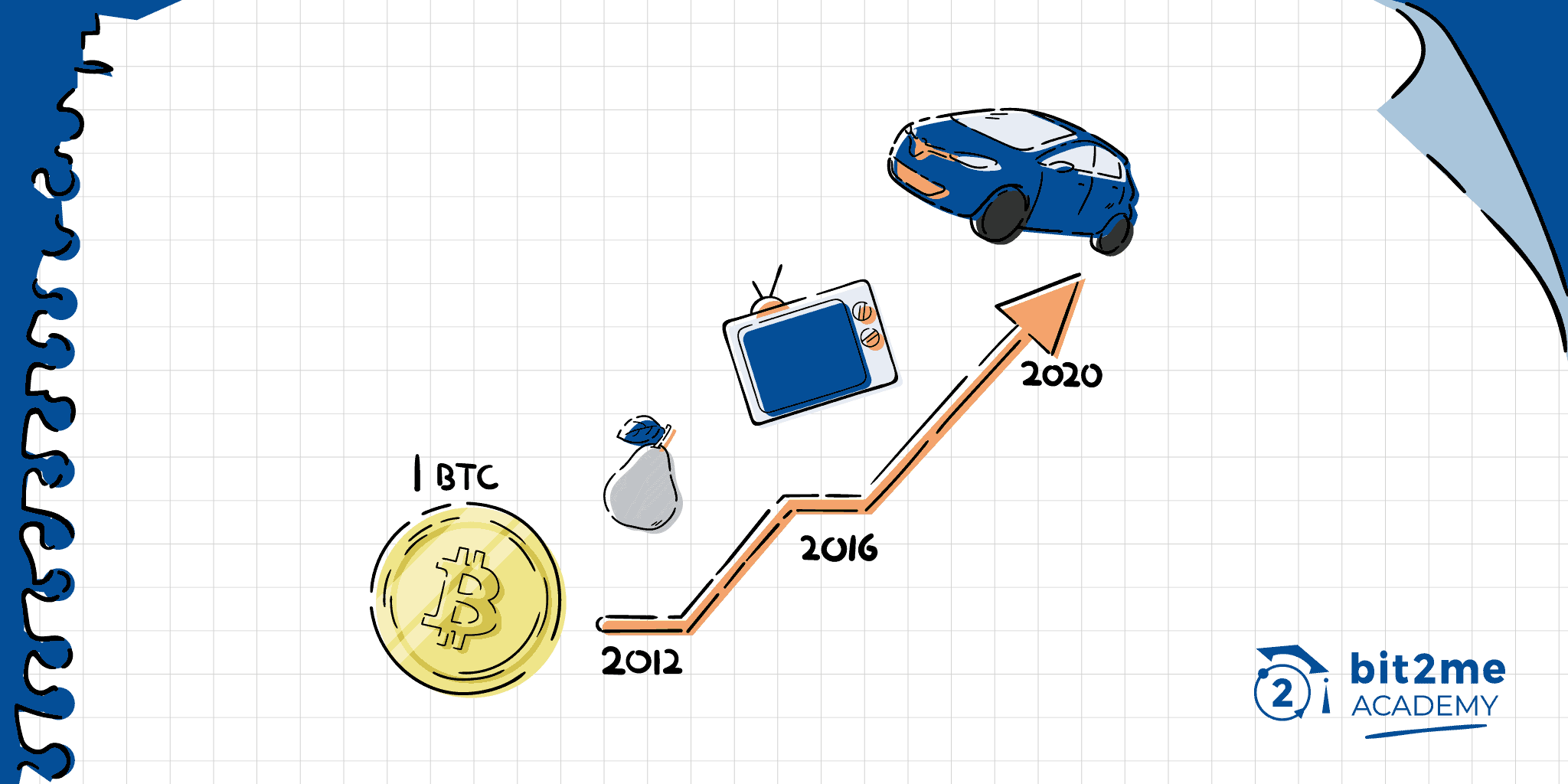

if you camt see from the chart here how much btc have deflated since 2010 then you have no bussimess talking about it.

or the economy surrounding it.

your just not equipped to see it. -

2024-03-20 at 1:37 AM UTC

-

2024-03-20 at 1:40 AM UTC

Originally posted by Charles Ex Machina if you camt see from the chart here how much btc have deflated since 2010 then you have no bussimess talking about it.

or the economy surrounding it.

your just not equipped to see it.

Bitcoin is the ultimate example of a deflationary cryptocurrency. It's by design you FUCKING RETARD

-

2024-03-20 at 1:40 AM UTC

-

2024-03-20 at 1:42 AM UTChttps://www.wsj.com/finance/currencies/bitcoin-inflation-hedge-84f6b840

Deflation in Bitcoin

The nature of deflation in Bitcoin contains two primary rules:

Only a total of 21 million coins will be issued

Every four years there is a 50% reduction of the bitcoin reward that the miners receive for the validation of the blocks. This reduction is called halving.

In addition to this, it must be taken into account that both hoarding and adoption by users keep the value increasing.

Limited money supply

The first great factor that influences the fact that bitcoins increase in value is in the limitation of the issue of the money supply (total amount of bitcoins that will exist) and in the halving process. These two elements cause the amount of total digital coins that can be distributed to be finite and the coin release to be automatically adjusted every four years. This makes the process transparent and implies an increase in value because every 10 minutes there are fewer coins that will reach the market. This is a clear example of deflation in Bitcoin.

Progressive emission reduction

At bitcoin mining process there are some norms that establish the consensus that all miners and nodes. involved respect. The Bitcoin blockchain requires miners for the validation of the transactions and the generation of the blocks, and it also requires nodes to verify the transactions by grouping them into blocks. Block that are then stored and disseminated throughout the network. Mining is encouraged by two factors: transaction fees and reward for generating the blocks.

When it's made a transaction with bitcoins (and with practically the majority of cryptocurrencies on the market) in addition to the amount that is sent to the recipient, an amount is marked that is the commission that the miner who validates the transaction in question will keep.

Additionally, miners receive a reward for validating transactions and creating blocks. Each of these blocks includes a certain number of new bitcoins that are put into circulation to exchange or store.

This form of issuance is programmed to gradually reduce the amount of bitcoins that are issued or discovered in each new block. In the Bitcoin code it is established that every 210.000 blocks, the amount of bitcoins emitted in each block will be reduced by 50% in a process that, as we have already mentioned, is called halving.

So every ten minutes a certain amount of bitcoins are injected into the network, which is adjusted every four years. This is until 2140, which will be when this bitcoin release process is finished. It will be at that time when the miners will be supported solely by the commissions of the transactions.

Energy consumption

Another important factor is in the energy consumption necessary to keep the blockchain and security in the Bitcoin network. Miners and nodes have the incentive to maintain the network for the reward that they receive fixed every 10 blocks that varies every four years. So they are compensated by the energy, computational and temporal cost for these operations.

When there is no compensation for this work, or rather it is no longer profitable, miners and nodes could stop working on transaction validation and network stability.

This is best understood with an example. We have a bricklayer who goes to a house to reform a room. The bricklayer has material costs, physical labor costs and it will take him a while to complete this work. When the work is done, you will present us with an invoice that will consider these factors and logically will report a certain economic benefit.

Miners do the same, but digitally. And the moment they do not receive a financial consideration that meets their needs and gives a return, they will stop working to maintain the network.

Thus the value of the bitcoins can only increase if the value of these increases. For example, a box of cookies that costs € 1, will cost less in bitcoins if the price of these increases. Although its price in fiat money does not suffer any variation.

Bitcoins acquisition

The value of bitcoins is also influenced by adoption and its hoarding or saving. Miners typically sell the amount of bitcoins needed to cover the fundamental costs: electricity, maintenance, and new equipment. The rest can be stored with the intention of selling it in the future, when the value of the bitcoins grows.

Let's take as an example the first time it was paid with bitcoins that was when Laszlo Hayneck he paid two pizzas at an American pizza chain and it cost him 10.000 BTC, which at the time was roughly $ 30. Those same pizzas in December 2017, when bitcoin was at $ 18.000 would have only amounted to 0.0016666 BTC.

Adoption as a payment method

The fourth and final factor for Bitcoin deflation is adoption as payment method. The more people choose to buy and sell with bitcoins, the more value they will have. Since the amount is finite, not only because there is a maximum amount of bitcoins that can be in circulation. But because people keep a part of these bitcoins and the rest that is available in the market is not the same as the one in circulation.

So that it is better understood. At the beginning of October, we found about 17.3 million bitcoins in circulation. But in reality they are not all in the market through sales offers. In fact, there is a smaller quantity that is impossible to quantify than is actually available on the market.