User Controls

Buying Crypo

-

2024-03-20 at 1:42 AM UTC

-

2024-03-20 at 1:45 AM UTC

Originally posted by Ghost https://www.wsj.com/finance/currencies/bitcoin-inflation-hedge-84f6b840

since you still cant see how the worth of btc is determined ENTIRELY by the supply of fiat monies, you really need to stop talking about this, -

2024-03-20 at 1:48 AM UTC

-

2024-03-20 at 1:50 AM UTC

its not arbitrary.

its determined by the fiat money supply. -

2024-03-20 at 1:52 AM UTCthe fiat money supply is completely made up fake bullshit which is why crypto just ignores it

-

2024-03-20 at 1:54 AM UTC

-

2024-03-20 at 2:06 AM UTC

Originally posted by Charles Ex Machina

then why the crypto community still keep appraising the worth of their digital "currency" in fiat metrics.

because the market values crypto as an asset, a security or investment. Crypto and fiat are completely incompatible so it makes sense that fiat would just slap a "price" on 1 BTC as if it were a pound of wheat or gold, that makes sense it's a market answer and as a bitcoin user myself since the very start I have sold thousands of dollars worth. I currently own $1000 USD "worth" of bitcoin and I need the money so I am willing to sell it for that price.

But if I could just take that BTC to a store and pay them an amount which would be entirely independently determined by the bitcoin network and what a vendor is willing to trade a good for any amount of BTC and there would be no cashing out to an exchange for fiat.

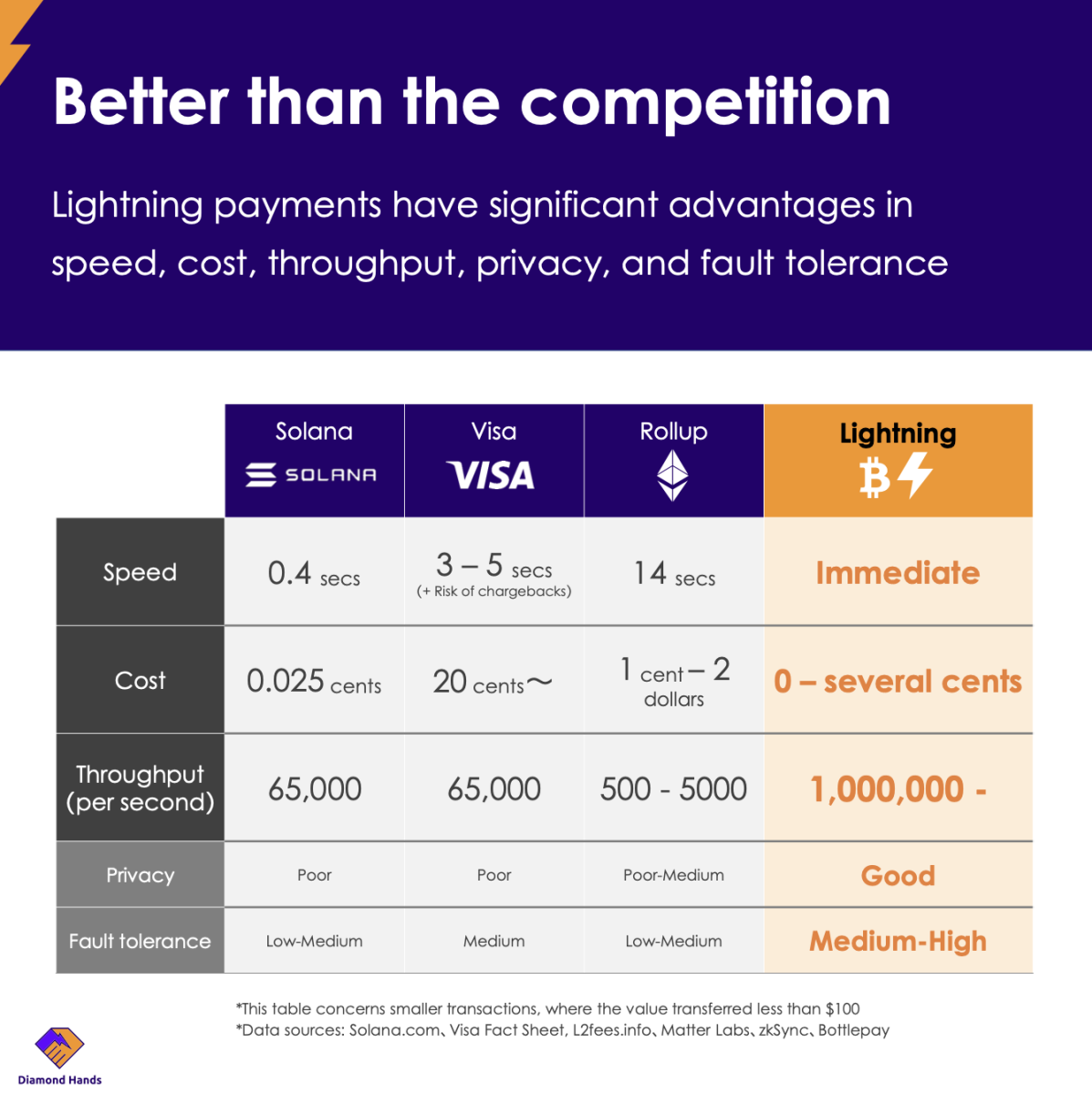

I would pay lets say 0.005 BTC and a small network fee to send the coin to the vendor instantly by scanning my phone and the trade would be done, no need for a bank or anything. It's a superior technology which is why fiat values it so highly

Bitcoin is so advanced that people even use the network to mint NFT's.Impact of Bitcoin Ordinals

The impact of Bitcoin Ordinals is best illustrated through the division it has created among Bitcoin users. This new functionality on Bitcoin has sparked a heated debate among users who have differing opinions on whether Ordinals are beneficial for the network.

Some supporters argue that Ordinals are an innovative and elegant way to make Bitcoin more sustainable over the longer term by creating more demand for block space, because Bitcoin will eventually lose its block rewards and become completely reliant on transaction fees for miner revenue. They also say that Ordinals attract new developers and users who were previously more interested in other non-Bitcoin crypto projects.

Advocates also claim that Ordinals are more secure, decentralized, and censorship-resistant than traditional NFTs, which rely on third-party platforms and intermediaries.

However, some critics contend that Ordinals are a misuse of the Bitcoin network and a waste of its scarce resources. They point to the large amount of data associated with Ordinal inscriptions and the increased demand for block space, which could lead to higher fees and congestion on the network.78

Additionally, they question the legality and ethics of Ordinals, which could be used to conduct scams on the blockchain by issuing fraudulent assets. It is also argued that Ordinals aren’t compatible with the original vision and design of Bitcoin, which is meant to be a P2P electronic cash system. -

2024-03-20 at 2:09 AM UTChttps://www.cnbc.com/2023/07/17/ripple-hopes-judge-ruling-in-sec-case-will-lead-to-us-banks-using-xrp.html

Blockchain startup Ripple is confident U.S. banks and other financial institutions in the country will start showing interest in adopting XRP

in cross-border payments after a landmark ruling determined the token was not, in itself, necessarily a security.

The San Francisco-based firm expects to start talks with American financial firms about using its On-Demand Liquidity (ODL) product, which uses XRP for money transfers, in the third quarter, Stu Alderoty, Ripple’s general counsel, told CNBC in an interview last week.

Last week, a New York judge delivered a watershed ruling for Ripple determining that XRP, a cryptocurrency Ripple is closely associated with, in itself was “not necessarily a security on its face,” contesting, in part, claims from the U.S. Securities and Exchange Commission against the company.

Ripple has been fighting the SEC for the past three years over allegations from the agency that Ripple and two of its executives conducted an illegal offering of $1.3 billion worth via sales of XRP. Ripple disputed the claims, insisting XRP cannot be considered a security and is more akin to a commodity.

Ripple’s business suffered as a result, with the company losing at least one customer and investor. MoneyGram, the U.S. money transfer giant, ditched its partnership with Ripple in March 2021.

Meanwhile, Tetragon, a U.K.-based investor that previously backed Ripple, sold its stake back to Ripple after unsuccessfully trying to sue the company to redeem its cash.

Asked whether the ruling meant that American banks would return to Ripple to use its ODL product, Alderoty said: “I think the answer to that is yes.”

Ripple also uses blockchain in its business to send messages between banks, kind of like a blockchain-based alternative to Swift.

“I think we’re hopeful that this decision would give financial institution customers or potential customers comfort to at least come in and start having the conversation about what problems they are experiencing in their business, real-world problems in terms of moving value across borders without incurring obscene fees,” Alderoty told CNBC Friday.

“Hopefully this quarter will generate a lot of conversations in the United States with customers, and hopefully some of those conversations will actually turn into real business,” he added. -

2024-03-20 at 2:12 AM UTC↑

cant tell the differemce between technical white paper and marketing literature.

"some supporters argue"

"advocates also claim"

"some critics contend"

-

2024-03-20 at 2:24 AM UTCthere is a pretty clear difference but most of crypto is infected with marketing literature, it's impossible to avoid but that doesn't mean there isn't real cryptography science. What is the literature talking about.

It's sad that the market is all sillycoon valley and banks and regulators but it is what it is. The technology will resist them all -

2024-03-20 at 3:51 AM UTCValue is entirely relative and always changing.

-

2024-03-20 at 4:38 AM UTC

Originally posted by Ghost https://www.cnbc.com/2023/07/17/ripple-hopes-judge-ruling-in-sec-case-will-lead-to-us-banks-using-xrp.html

promotional material.

"is confident, expects, hopes".

the article serves to advertise and convimce potential stake holder that eth is not a security and therefore shall not be regulated and taxed as one.

nothing about worth or value.

the onlyfans of financial world. -

2024-03-20 at 4:39 AM UTC

-

2024-03-20 at 4:40 AM UTC

Originally posted by Ghost there is a pretty clear difference but most of crypto is infected with marketing literature, it's impossible to avoid but that doesn't mean there isn't real cryptography science. What is the literature talking about.

It's sad that the market is all sillycoon valley and banks and regulators but it is what it is. The technology will resist them all

theres also very real science behind the forces that turn foods into feceses out of your asshole but that doesnt mean your feceses are just as worthy as the food you stuff into you're mouth. -

2024-03-20 at 4:51 AM UTC

Originally posted by Charles Ex Machina promotional material.

"is confident, expects, hopes".

the article serves to advertise and convimce potential stake holder that eth is not a security and therefore shall not be regulated and taxed as one.

nothing about worth or value.

the onlyfans of financial world.

it's about an SEC ruling you fucking idiot -

2024-03-20 at 4:56 AM UTC

-

2024-03-20 at 1:18 PM UTC

-

2024-03-20 at 1:19 PM UTC

-

2024-03-20 at 1:20 PM UTC

-

2024-03-20 at 1:27 PM UTC