User Controls

How do you prioritize your monetary savings?

-

2018-07-30 at 4:02 PM UTCAlways buy goldThe following users say it would be alright if the author of this post didn't die in a fire!

-

2018-07-30 at 5:05 PM UTC

-

2018-07-31 at 11:56 PM UTCWhy wouldn't you?

-

2018-08-01 at 12:19 AM UTC

Originally posted by DietPiano That is a terrible idea.

Buy some gold? Yes, absolutely. Buy lots of gold? Only if you are sure a major crash is imminent.

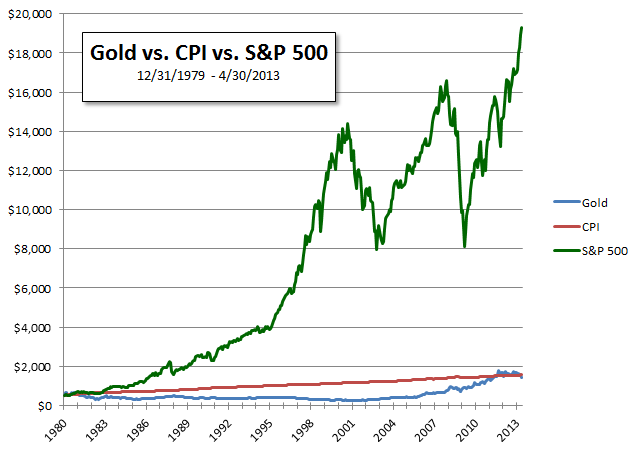

Gold does not outperform a market index over a 10 year period except for brief periods of time.

Tell that to all those people in 1932. Gold and Silver never goes down in value, the older the better. -

2018-08-01 at 1:12 AM UTC

-

2018-08-01 at 1:43 AM UTC401k match, roth ira, then just general non-retirement investment.

-

2018-08-01 at 1:47 AM UTC

-

2018-08-01 at 2:39 AM UTC

Originally posted by giddyup Tell that to all those people in 1932. Gold and Silver never goes down in value, the older the better.

Gold has been flat or slightly down for the past 5 years. The market index has steadily grown by about 65% in the last 5 years. Gold has more peaks and valleys throughout, but overall it's simply a weaker investment medium for mid and long term investing. -

2018-08-01 at 5:12 AM UTC

Originally posted by Ajax Curious about your reasoning for not going back to the 401k before doing the general non-retirement investment.

May want to buy property at some point so I want to be able to draw on it without penalty.

It did just occur to me the other day that interest on a home loan is less than average return on reasonable index funds which kinda surprised me. I guess means it makes sense to make the minimal down payment on a property and keep any funds available invested instead of putting them towards that debt? IDK, that wasn't the way I was thinking when I set stuff up, I kinda assumed you always want to pay down debts before making investments, and still kinda feel that way just on a gut level.

Also it's nice to fantasize about retiring at 30 and just living as cheaply as possible in montana or something. -

2018-08-01 at 5:24 AM UTCThere is no feeling like living in a house with a paid off mortgage.

Now, if those motherfuckers would just quit jacking up my taxes every two years!The following users say it would be alright if the author of this post didn't die in a fire! -

2018-08-01 at 5:40 PM UTCAverage mortgage interest rate is lower than the average rate of return of an index fund, so mathematically, it makes sense to pay minimally towards the mortgage and max out investments. However, that does not consider risk. Main risk is something happening and negatively affecting your cash flow or ability to earn income, and then you’re stuck with a big mortgage note that you can’t pay.

My goal is to pay off my house by the time I’m 40, while investing heavily along the way. -

2018-08-09 at 3:37 PM UTCHighest last

front first

heads up -

2018-08-09 at 3:41 PM UTCNo.

It's "Ass up, head down." -

2018-08-10 at 4:30 PM UTC

Originally posted by Lanny May want to buy property at some point so I want to be able to draw on it without penalty.

It did just occur to me the other day that interest on a home loan is less than average return on reasonable index funds which kinda surprised me. I guess means it makes sense to make the minimal down payment on a property and keep any funds available invested instead of putting them towards that debt? IDK, that wasn't the way I was thinking when I set stuff up, I kinda assumed you always want to pay down debts before making investments, and still kinda feel that way just on a gut level.

Also it's nice to fantasize about retiring at 30 and just living as cheaply as possible in montana or something.

Would that be cheap, run down trailer parks, Lanny, so you can become a slum lord? lol -

2018-08-10 at 8:19 PM UTC

-

2018-08-13 at 11:41 PM UTC

-

2018-08-17 at 9:07 PM UTCFood first

-

2018-08-17 at 9:22 PM UTC

-

2018-08-17 at 10 PM UTCIf your in come is not eaual.tomypur out go you are fked.

-

2018-08-17 at 10:20 PM UTCLol