III. ELECTRONIC & COMPUTER SCAMS

Scarcely a week goes by that I don't hear about one scheme or another successfully used by phreaks & hackers to penetrate large systems to access data banks and to perform various manipulations.

Although we have only been able to verify one or two of the methods that we will discribe, numerous cases have arisen in recent years in which an ATM was defrauded with no evidence of a hardware or software bug to account for the robbery.

The outlaw can use several approaches. One is to use wiretapping. Another is to obtain the secrets of the cipher, or hardware or software defeats to the system and proceed accordingly. Another one that works with banks is to set up phony debit accounts and program the computer to beleive that the debit accounts are full of money. Then when a three day weekend comes around proceed with friend to deplete all of these debit accounts by making various rounds to ATMs.

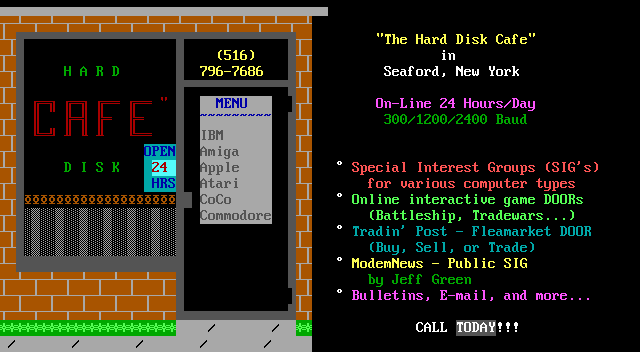

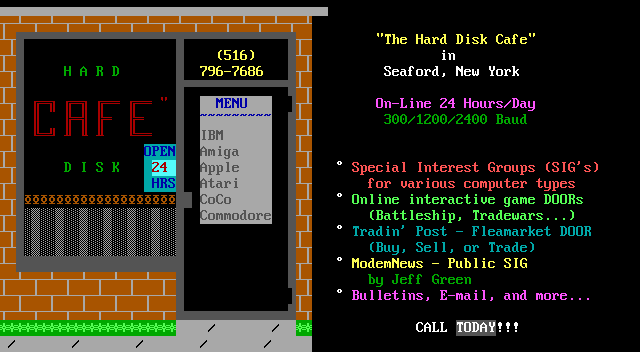

Electronic frauds of ATMs require an excellent technical understanding of phone and-or computers all of which you can obtain from worthy underground news letters such as TAP, and 2600, etc. OR from a H/P BBS.

"Tapping" or "wiretapping" consists of the unauthorized electronic monitering of a signal (voice or digital) transmitted over a phone or computer (commo) circuit. A "tap" is the monitoring device that does this. Athough a tap is usually placed somewhere on a phoneline or junction box, it may be placed inside of a phone, modem or computer.

With the advent of isolated stand-alone ATMs (with vulnerable phone lines, including POS terminals) and computer technology. The phone circuits that connect ATMs to their host computer (located in the banks data processing center) can be tapped anywhere between the two.

An "invasive tap" is one in which a hard electronic connection is made between the tap and the commo circuit. A "non-invasive" tap is one in which an induction loop or antenna is used to pick up the EMI generated by the signal, and there is no physical connection between the commo circuit and the line.

A "passive tap" is one in which the tap simply tramits to a recorder or directly records the tapped signal and in no way interfers with it. An "active tap" is one in which the tap ALSO interferes (changes,adds to or deletes) the tapped signal in some way. Active taps are more sophisted. A typical ATM active tap is one that records a signal, the later plays it back over the line.

Be sure to look for my text "HIGH TECH TOYS" it lists were to get things that are VERY hard to get or things that you may need a license to obtain without those hassles all you need will be money!

Method 1. PASSIVE TAPS

All tapped ATM transactions are recorded over a period of time (but not interfered with). Once the serial protocal and MA codes are understood, the transmitted data is decrypted (if encrypted) using known entry data to the ATM. Note that some systems use a MA code that is complex and very difficult to crack.

Messages to and from the ATMs host computers are composed of various fields. One field identifies the transaction type, one the PIN, one the PAN, one the amount, one the approval code, one the transaction number and perhaps other fields. In most systems, either nothing is encrypted or only the PIN field. In others, the entire message is encrypted.

The ATM/host circuit is monitored over a period of time to deterive PINs,PANs and other entry data of other ATM users based upon (decrypted) transmitted data. Phony debit cards are then made to defraud ATM accounts with known PINs and PANs.

Method 2. ACTIVE TAPS

Active tapping is one method of spoofing. The c4ritical part of the host computer's message are the approval and amounts fields. The critical parts of the ATMs transmission are the continuous transmission it makes to the host computer when NO one is using it to indicate that it is OK, and the PIN and amount fields. Booth good and bad cards and good and bad PINs are entered at various times and days to differentiate between the various massage components. Various quiescent periods is also recorded.

Once the message structures are understood, a computer is then substituted to act as both the host computer and the ATM. That is, a computer is then connected between the ATM and the host computer. This computer acts like the host computer to the ATM, and like the ATM to the host computer.

An accomplice uses the ATM to go thru the motions of making legitimate transactions. If his procedures are correct, the ATM communicates, with the host computer for permission to discharge the money. Several methods:

(A) The phreaker changes the approval field in the hosts message to OK the transaction regardless of its real decision. The phreaker may interdict the message regardless of iits real decision. The phreaker may interdict the message from the ATM to tell the host that the ATM is inactive while it interdicts the host message to tell the ATM to disburse the cash. Since the ATM is no longer connected to the host computer, and the host computer believes that it is talking to an unused ATM (or one engaged in balance inquiry transaction), no monies will be deducted from any debit account, no denials will be made based upon daily maximum limits, and no alarm will be sounded due to suspicious behavior. Even if the ATM sounds an alarm, the host computer wont hear it as long as the phreaker is whispering sweet nothings into its ear. Also by using this method, as long as the PIN & PAN check digits are legitimate ones based upon the ATMs preliminary and cursory checks, the PINs and PANs themselves can be phony because the host won't be there to verify legitimacies! That is no legal PINs and PANs need be known nor the algorithm for encrypting PINs.

(B) The ATMs message is replaced by a previously recorded legitimate transaction message played back by the phreaker. The cash is despense as before. The play back method won't work if the encryption or MA process embed a transaction, clock or random code into the message, making all messages unique.

(C) The phreaker/hacker changes the PIN field in the ATMs message to a legitimate PIN of a fat-cat like DONALD TRUMPs account. The phreaker/hacker then withdraws someone else's money.

(D) The phreaker/hacker changes the amount field in the ATMs message to a much lower one, and then changes the amount field in the host's message back to the higher amount (debit transactions- the opposite changes are made for credit transactions). Sooo the phreaker can withdraw $200 from his account with only $10 actually debited from it by the host. He can then make many withdrawals before the host cuts him off for exceeding the daily max.

Method 3. TEMPEST IV

A thin induction pick-up coil, consisting of many turns of one thickness of #28 or thinner enamel wire sandwiched between two self-adhesive labels, no larger than a debit card, can be inserted at least part way inside the card slot of most ATMs. This coil is then used to "listen in" on the electrical activity inside of the ATM to try to determine which signals control the release of money. Using this same coil as a transmitter anteenna, these signals are then transmitted ti the realse logic to activate it.

It is believed that a thin coil about the size of a dime can be maneuvered quite a ways inside most ATMs for sensing purpose, and that small metal hooks have also been fed into ATMs to obtain direct hookups to logic and power circuits.

It is believe that some outlaws have obtained ATM cards. They then machined out the inside of the cards, except the magnetic strip. They then place flat coils inside the machined out area. They then monitor the coils during legitimate transactions. They can also use the coils to transmit desired signals. This is kind of the method used in TERMINATOR 2.

IV. BOGUS CARD, GETTING PINs

Almost all credit cards now come with either a hologram or an embedded chip ("Smart Card"), and are thus nearly impossible to counterfeit to date. However, since most debit cards are not optically read by ATMs, they are much easier to counterfeit. To counterfeit a card the following is needed:

(1) A card embosser, which can be readily obtained from commercial sources (see "Embossing Equipment and Supplies" or similar in the Yellow Pages) without question asked. A used, serviceable embosser ran use $210 + shipping & handling.

(2) A magnetic stripe decoder/encoder (skimmer), which can be purchased from the same company as the embossing equipment or just look in the back of Computer Magazines.

(3) PIN checkers are not known to be available to the general public. However, if one were stolen, the user could guess at card PINs by trial-and-error effort based upon the knowledge of how PINs are derived.

(4) PANs,PINs and ciphers, which can be obtained from a number of ways usually involving theft. About 50% of ATM users write their PINs either on their debit card or somewhere in there wallet or purse. And most user-chosen PINs are easily guessed. The encrypted PINs can be directly lifted or read from the magnetic stripe, and the encryption scheme determined by comparing the encryption with the known PIN # of a dozen or so cards.

V. NOTE

Now this text covers the file that I have put together on ATMs but I know that there is more on the subject that I have left out either because I dont want to put it or because my staff: The High-Tech Hoods did get or know the info. now I am open to suggestions for ATM 2 but I dont want any ideas I want proof. !! Then I'll publish it and give credit where credit is due.

To the best of our knowledge, the text on this page may be freely reproduced and distributed.

If you have any questions about this, please check out our Copyright Policy.

totse.com certificate signatures