User Controls

Inflation will cause the government debt bubble to bust in the west

-

2021-05-02 at 5:33 PM UTC

-

2021-05-03 at 9:11 PM UTC

-

2021-05-03 at 9:49 PM UTCNothing is denominated in bitcoin, whereas lots of contractual obligations, like commodity trading agreements, government bonds, and wage agreements are denominated in fiat. Those obligations provide stability.

-

2021-05-05 at 12:56 AM UTC

Originally posted by Donald Trump Nothing is denominated in bitcoin, whereas lots of contractual obligations, like commodity trading agreements, government bonds, and wage agreements are denominated in fiat. Those obligations provide stability.

1- yet.

2 - not just fiat but mostly in USD.

also most people mistook coordinated price gouging by industry players for "inflation" because thats exactly how these big capitals, through their mouthpiece "economists" propagandized them to be.

inflation occurs due to natural economic forces, while price gourging occurs due to manipulation of the price discovery mechanism by the monopolistic suppliers.

another thing that looks like inflation but isnt is systemic currency devaluation. inflation reduces the purchasing power of the masses, but when the increase of prices of goods is matched by the increase in governmemt handouts to compensate for their loss of buying power, then inflation doesnt happen.

what happen is that their currency is losing its value. -

2021-05-05 at 9:17 AM UTC

Originally posted by vindicktive vinny 1- yet.

2 - not just fiat but mostly in USD.

also most people mistook coordinated price gouging by industry players for "inflation" because thats exactly how these big capitals, through their mouthpiece "economists" propagandized them to be.

inflation occurs due to natural economic forces, while price gourging occurs due to manipulation of the price discovery mechanism by the monopolistic suppliers.

another thing that looks like inflation but isnt is systemic currency devaluation. inflation reduces the purchasing power of the masses, but when the increase of prices of goods is matched by the increase in governmemt handouts to compensate for their loss of buying power, then inflation doesnt happen.

what happen is that their currency is losing its value.

No one is interested in signing a contract denominated in a commodity the value of which changes massively and rapidly. For instance imagine if I made a contract to pay someone ½ a bitcoin a week in March 2020 - it was about $2,500 then, it's over $25,000 now.

Also when currency devaluation happens keep in mind a lot of people have their debt and rents reduced in real terms. And people adjust to inflation - in Weimar Germany companies had systems of tables they could look up to figure out how much they should be charging for stuff and paying staff each day. -

2021-05-05 at 1:49 PM UTC

Originally posted by Donald Trump No one is interested in signing a contract denominated in a commodity the value of which changes massively and rapidly. For instance imagine if I made a contract to pay someone ½ a bitcoin a week in March 2020 - it was about $2,500 then, it's over $25,000 now.

Also when currency devaluation happens keep in mind a lot of people have their debt and rents reduced in real terms. And people adjust to inflation - in Weimar Germany companies had systems of tables they could look up to figure out how much they should be charging for stuff and paying staff each day.

okay kike, the only reason it's so volatile is because of speculative hebrews.

1 bitcoin = 1 bitcoin. Doesn't change the mining algorithm or difficulty of the equation, because it's a computer program. They can't just BRRRRRRRRR bitcoin

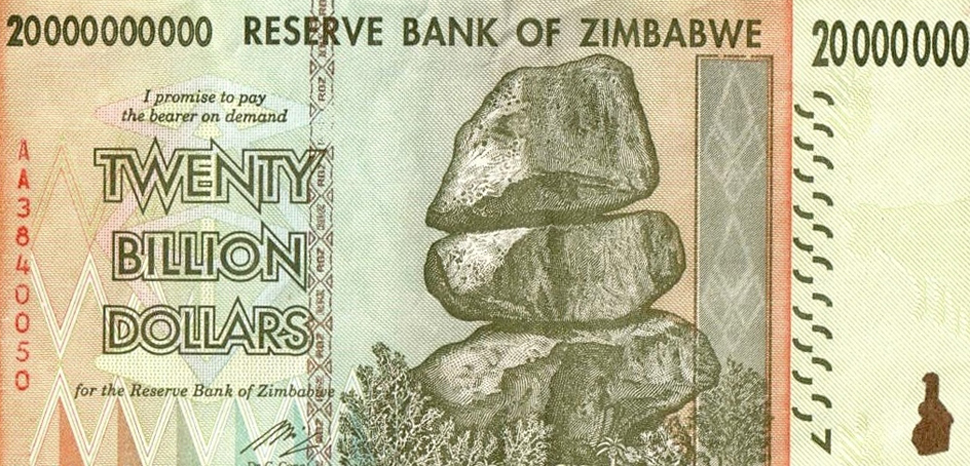

You will never see this happen to crypto

you will never see this happen either

https://www.forbes.com/sites/tatianakoffman/2020/07/09/lebanons-currency-crisis-paves-the-way-to-a-new-future/?sh=6bb9daa76a17

-

2021-05-05 at 2:04 PM UTC

Originally posted by Ghost okay kike, the only reason it's so volatile is because of speculative hebrews.

1 bitcoin = 1 bitcoin. Doesn't change the mining algorithm or difficulty of the equation, because it's a computer program. They can't just BRRRRRRRRR bitcoin

You will never see this happen to crypto

51% attack motherfucker -

2021-05-05 at 2:17 PM UTCthat only works on older coins, the new ones like 420x have built in safeguards to prevent that from happening.

-

2021-05-05 at 2:53 PM UTC

Originally posted by Donald Trump No one is interested in signing a contract denominated in a commodity the value of which changes massively and rapidly. For instance imagine if I made a contract to pay someone ½ a bitcoin a week in March 2020 - it was about $2,500 then, it's over $25,000 now.

they will sooner or later.

https://www.investopedia.com/terms/c/commodity-backed-bonds.aspAlso when currency devaluation happens keep in mind a lot of people have their debt and rents reduced in real terms. And people adjust to inflation - in Weimar Germany companies had systems of tables they could look up to figure out how much they should be charging for stuff and paying staff each day.

currency devaluation have little to no effect on local population, it only affects forex and trade with other nations.

what happened in weimar was inflation, and people can adjust to it but only up to a certain point before the entire system prolapses.

which is why venezuela, argentina and zimbabwe have worthless papers.

MMT can only work if people still want your money irregardless of how worthless it is. -

2021-05-05 at 3:22 PM UTCInflation is only a problem until people start importing hard currency to trade in - dollars or euros for instance.

Devaluation and inflation are more or less just different labels on the same thing, especially since most economies are open and have a high dependence upon imported grain and oil.

Inflation doesn't even necessarily imply expansion of the money supply - for instance there is imported inflation which can be caused by the rise in price of commodities traded with other countries. -

2021-05-05 at 3:32 PM UTC

Originally posted by Donald Trump Inflation is only a problem until people start importing hard currency to trade in - dollars or euros for instance.

Devaluation and inflation are more or less just different labels on the same thing, especially since most economies are open and have a high dependence upon imported grain and oil.

Inflation doesn't even necessarily imply expansion of the money supply - for instance there is imported inflation which can be caused by the rise in price of commodities traded with other countries.

importing hard currency ? whl does that ? -

2021-05-05 at 3:33 PM UTC

-

2021-05-05 at 3:38 PM UTC

Originally posted by Donald Trump Devaluation and inflation are more or less just different labels on the same thing, especially since most economies are open and have a high dependence upon imported grain and oil.

they describe the symptoms of different illness and deaseases.Inflation doesn't even necessarily imply expansion of the money supply - for instance there is imported inflation which can be caused by the rise in price of commodities traded with other countries.

you need to first increase and expand your money supply before you can buy stuffs from other country at a much higher price. -

2021-05-05 at 3:39 PM UTC

-

2021-05-05 at 3:44 PM UTC

-

2021-05-05 at 3:55 PM UTC

-

2021-05-05 at 3:56 PM UTC

Originally posted by Donald Trump Yes, having dollars is a common way to accumulate wealth.

Not many people have the facility to store barrels of oil, or feel confident trading in gold or silver.

what he's getting at is that foreign buyers using USD or euros or whatever else as a store of value is contingent on them accepting internal manipulation from the banks/financial system.

there's an equilibrium in that enough people are benefitting from the financial system's je'wish sorcery to keep it afloat; allowing them to do whatever it takes to stay profitable (ie. keeping long-term interest on bonds at 4% or whatever it is). alternatives are becoming more available and competitive (ie. China and alternative energy supply countries that were previously blockaded and/or sanctioned), and the more people leave the existing system the more unstable that equilibrium becomes -

2021-05-05 at 4:03 PM UTC

Originally posted by aldra what he's getting at is that foreign buyers using USD or euros or whatever else as a store of value is contingent on them accepting internal manipulation from the banks/financial system.

and their ability to get out of their native country because without this ability storing wealth in foreign curremcy is retarded.

imagine havimg a truckload of USDs in zambia and no money changer. just imagine that. -

2021-05-05 at 4:10 PM UTCI think Vinny has read too much Zerohedge. The Dollar and Euro are OK stores of wealth, assuming you are willing to lose 2-4% a year to inflation, far less volatile than a lot of currencies.

I don't think people are leaving the Dollar/Euro system in any number, and I don't think China or Bitcoin are any sort of credible alternative to it. I don't think there are any alternative energy supply countries besides Russia and Iran either, and those are both going to see declining production soon due to peak oil. Venezuelan crude oil is heavy and sulphurous, and not worth extracting at current prices, and if it was worth extracting Uncle Sam and Uncle Moishe would have to bring democracy. -

2021-05-05 at 4:18 PM UTC

Originally posted by Donald Trump I think Vinny has read too much Zerohedge. The Dollar and Euro are OK stores of wealth, assuming you are willing to lose 2-4% a year to inflation, far less volatile than a lot of currencies.

currently, sure

Originally posted by Donald Trump I don't think people are leaving the Dollar/Euro system in any number, and I don't think China or Bitcoin are any sort of credible alternative to it.

Bitcoin definitely not, but as for China, we'll see - especially as they continue to open Eurasian markets. Russia is specifically trying to pivot from the European market to the new ones.

Originally posted by Donald Trump I don't think there are any alternative energy supply countries besides Russia and Iran either, and those are both going to see declining production soon due to peak oil. Venezuelan crude oil is heavy and sulphurous, and not worth extracting at current prices, and if it was worth extracting Uncle Sam and Uncle Moishe would have to bring democracy.

Peak oil is... I dunno. I think we may have already passed it. I think Iran's got some of the biggest remaining supplies largely because they've been kept out of the market for so long.

Uncle Shmuel already had a go (a few actually) at 'democracy for Venezuela' but failed miserably, even though he's still fiddling with the thumbscrews. I don't really know much about their potential supply but I do know that they only have extraction facilities - crude is pumped straight from there to the US for refinement and (was) sold back for a huge profit. Potentially someone like Russia or China could help set them up with refinement facilities of their own but it may take too long to be profitable if at all