User Controls

I just rage quit my bank after 15 years and went to the credit union across the street (DISCUSS: banks vs credit unions)

-

2019-01-05 at 5 AM UTC

-

2019-01-05 at 5:05 AM UTCI won’t ridicule you too harshly, but comparing a flat rate to a percentage is not a true comparison.

You should have cashed a check to yourself for the maximum amount of overdraft protection (often $1,000). Then you could float yourself with cash and only be out $48. -

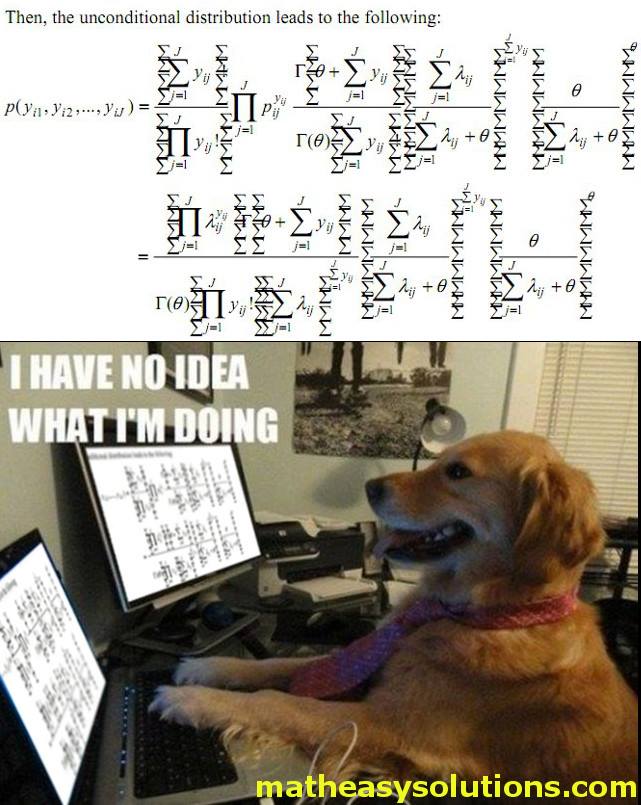

2019-01-05 at 5:09 AM UTCSomething seems wrong, hold up...

According to https://www.calculatorsoup.com/calculators/financial/simple-interest-plus-principal-calculator.php it's r = (1/t)(A/P - 1).

I'm just going to figure out how much of a time frame half a day is in years (decimals)...

t = 365 / 0.5 = 730.

A = total cost (principle plus penalties paid) = $200 + $48 = $248.

r = (1 / 730) * (248 / 200 - 1) = 0.00136 * 0.24 = 0.000329.

Ok, I should cut myself off right about here. -

2019-01-05 at 5:12 AM UTC

Originally posted by Ajax I won’t ridicule you too harshly, but comparing a flat rate to a percentage is not a true comparison.

You should have cashed a check to yourself for the maximum amount of overdraft protection (often $1,000). Then you could float yourself with cash and only be out $48.

The thing is though, I have no overdraft protection. I'm not sure I'm getting what you're driving at here because it doesn't seem to matter how much I'm overdrawn, the fee is always going to be $48.

I could literally paypal someone a single cent ($0.01) - if I have $0.00 in my account, that's overdraft, which means $48 fee.

Likewise, I could have wrote a check for $1,000,000,000 - still, $48 NSF fee. -

2019-01-05 at 5:23 AM UTC

-

2019-01-05 at 5:27 AM UTCThe following users say it would be alright if the author of this post didn't die in a fire!

-

2019-01-05 at 6:31 AM UTC

Originally posted by gadzooks I started a (personal / debt consolidation) loan application back in NOVEMBER with my bank (one of the big Canadian ones… think green color). While I have an okay salary, my credit isn't perfect. I did manage to pay off all my debts that were in collections, but I still have to build my credit from here. So, I got my dad to co-sign for me, and his credit is exemplary.

But they were just making me feel like my application wasn't important, making me chase them down to get things moving, and then, the straw that broke the proverbial camels back - THREE $48 NSF fees because I was a day late in moving some money into my checking account to cover some end-of-month bills (because I was expecting the loan to be approved my now and thus cover those expenses on time).

I told them that I keep applying for overdraft protection, and they keep rejecting me BECAUSE OF THINGS LIKE THIS…

It's fucking catch 22.

And then I thought - why the fuckam Idoes anyone who is working class keep their money in banks. Banks are for rich people.

Credit unions do like the wacky-waving-inflatable-arm-flailing-tube-man store does - "they pass the savings onto YOU!!"

But for real though, what are the pros and cons regarding each option? The more I think about it, the more it seems like a credit union is the way to go (for working class folk).

The differences may be marginal at best, but whatever, I needed a change anyway.

whoa dude cool it with the antisemitism, anti-bank is code word for anti jedi. you're not a racist are you?The following users say it would be alright if the author of this post didn't die in a fire! -

2019-01-05 at 6:45 AM UTC

Originally posted by Rizzo in a box whoa dude cool it with the antisemitism, anti-bank is code word for anti jedi. you're not a racist are you?

I just KNEW either you, or MORALLY SUPERIOR BEING III, would have taken it there.

He did though, first page, ever-so-subtly. It's like a Where's Waldo adventure.

Btw, I'm not antisemitic, some of my best friends are bankers! -

2019-01-05 at 6:57 AM UTC

Originally posted by gadzooks I just KNEW either you, or MORALLY SUPERIOR BEING III, would have taken it there.

He did though, first page, ever-so-subtly. It's like a Where's Waldo adventure.

Btw, I'm not antisemitic, some of my best friends are bankers!

make sure to tell every banker that you know, "thank you for your service"

they'll appreciate it -

2019-01-05 at 7:09 AM UTC

-

2019-01-05 at 7:17 AM UTCThe following users say it would be alright if the author of this post didn't die in a fire!

-

2019-01-05 at 12:26 PM UTCWhy let jedis have control of usury? or demons? or this giant demon egg? should we just let it hatch?

-

2019-01-06 at 3:08 AM UTC

Originally posted by gadzooks I've been researching and learning all kinds of stuff about how to build credit as efficiently as possible - although there's no one single definitive quantitative answer (which is ironic, because it's all based on mathematical formulas, which are as quantitative as it gets).

But different credit bureaus, financial institutions, and even third-party organizations (like credit karma), all use their own unique formulae to calculate credit risk.

But, a few of the take-homes that seem pretty universal:

1. First of all, if you have anything in collections, that's always the first thing to deal with.

2. Apparently the more lines of credit you have, the better, and especially the more diverse (mortgage; car loan; credit cards; etc). This one is often counter intuitive to people, but it shows (as long as you make steady payments) that you can manage credit/debt.

3. Applying for a credit card isn't going to cause your credit score to drop by 100 points. People are SO unnecessarily paranoid about getting a "credit check ding" on their record. Like, yeah, it does factor in, but nowhere near as much as people think.

There are some other theories that are out there, such as establishing certain debt-to-credit-limit ratios and stuff, but it gets a bit more fuzzy there.

Negative credit such as past due payments or collections obviously is the biggest problem with improving your score.

The debt to credit ratio is the number 1 factor in improving your score. If you use less than 35% of each credit account for 2 years and no late payments or collection accounts or judgements .. you can achieve a very good credit score.

If you have more that 4 hard credit pulls in 1 year, it is possible to see a big drop in your score. It happened to me because my mortgage lender screwed up ... it can take up to 2 years to cycle through. But 1 year is the normal amount of time, before your score will go back up. -

2019-01-06 at 3:24 AM UTCAlso, if your parent put one of their oldest credit cards with good payment history, in your name (that has a high credit line with very little use) that will really help. They don’t even need to give you the actual card. Your poor credit will not effect theirs. Only if you file bankruptcy after it was in your name, because that card would be connected to them.

I did this for my partner after his bankruptcy and his score went from zero to almost 700 in less than 2 years. -

2019-01-06 at 4:07 AM UTCi can not believe how much your banks had managed to instill subservience in all of you.

and they still deny the existence of capital feudalists. -

2019-01-06 at 4:53 AM UTCCredit unions are wannabe banks that cry about not being treated to the same regs as banks.

Never use them. -

2019-01-06 at 8:17 AM UTC

Originally posted by gadzooks I started a (personal / debt consolidation) loan application back in NOVEMBER with my bank (one of the big Canadian ones… think green color). While I have an okay salary, my credit isn't perfect. I did manage to pay off all my debts that were in collections, but I still have to build my credit from here. So, I got my dad to co-sign for me, and his credit is exemplary.

But they were just making me feel like my application wasn't important, making me chase them down to get things moving, and then, the straw that broke the proverbial camels back - THREE $48 NSF fees because I was a day late in moving some money into my checking account to cover some end-of-month bills (because I was expecting the loan to be approved my now and thus cover those expenses on time).

I told them that I keep applying for overdraft protection, and they keep rejecting me BECAUSE OF THINGS LIKE THIS…

It's fucking catch 22.

And then I thought - why the fuckam Idoes anyone who is working class keep their money in banks. Banks are for rich people.

Credit unions do like the wacky-waving-inflatable-arm-flailing-tube-man store does - "they pass the savings onto YOU!!"

But for real though, what are the pros and cons regarding each option? The more I think about it, the more it seems like a credit union is the way to go (for working class folk).

The differences may be marginal at best, but whatever, I needed a change anyway.

To be fair I have heard you can't join a credit unoin without semi decent credit rating. I have been told this by a few people that have tried to open accounts at coast capital and envision. By the way TD fucking sucks monkey balls. Play with the big boys and hit RBC up biatch -

2019-01-06 at 11:10 AM UTC

-

2019-01-06 at 1:15 PM UTCI learnt long ago to never set up direct debits(not sure what you guys call them over there) to pay bills etc. When I take out things like car insurance and isp's etc where they insist on you setting IP direct debit to pay monthly. I will set it up, give it a week then call my bank and cancel it. The companies moan like fuck and will keep on at you to set it up again but as long as you pay them every month they won't lose a customer over it.

Getting charged by the bank just because I got paid late and don't have the balance available to cover a direct debit just isn't acceptable in my book.

. -

2019-01-06 at 1:20 PM UTCBut yeah agreed the banks are taking the piss charging you 50 quid just for telling a company "no sorry, he doesn't have enough money to pay that bill".

In fact they don't even do that. The computer just automatically doesn't pay it and then charges your account for the privilege. Thats some easy money the banks make right there.

.