User Controls

Did the Russians Hack Fed Reserves?

-

2024-06-25 at 9:44 PM UTCapparent link of someone broadcasting the dump (most likely fake.. I don't see much)

https://x.com/Breaking911/status/1805696636112261621

attemp code one

attempt code two

[video]https://x.com/Breaking911/status/1805696636112261621

[/video]

fail? -

2024-06-25 at 9:46 PM UTCYes fail on your part.

What would that mean though? -

2024-06-26 at 12:33 AM UTCtwitter videos don't work for some homosexual reason but no they couldn't hack their bag out of a wet paper bag

But they don't need to because I Have evidence they have the technology to disregard international sanctions

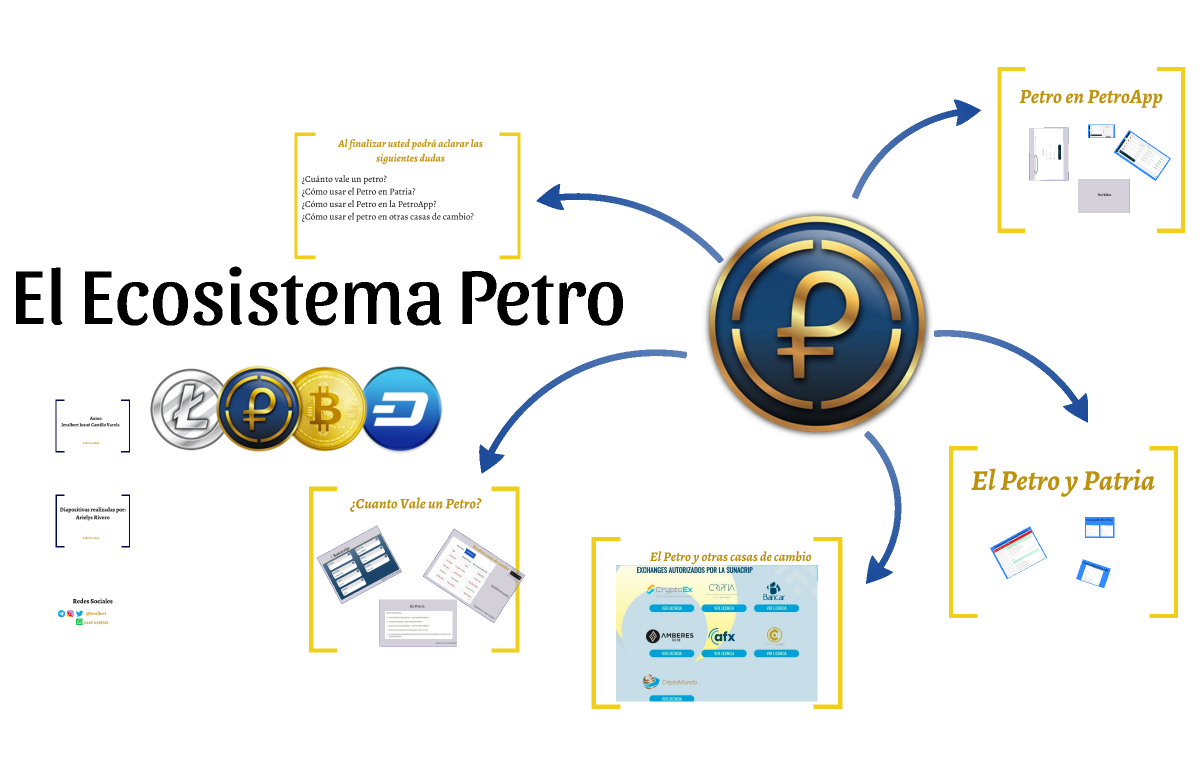

https://niggasin.space/thread/79449For the Petro to prosper, it needs international support. We already established how the US feels, in fact, they’ve recently doubled down on their stance by sanctioning a Russian bank saying: “When the failed Venezuelan cryptocurrency, called the Petro, launched in 2018, Evrofinance emerged as the primary international financial institution willing to finance the Petro. Early investors in the Petro were invited to buy the cryptocurrency by wiring funds to a Venezuelan government account at Evrofinance. Evrofinance’s involvement in the Petro demonstrated Maduro’s hope that the Petro would allow Venezuela to circumvent U.S. financial sanctions.”

The whole country, on the other hand, is not ready to commit. Despite high hopes from Maduro’s camp regarding dealings in Petro with Russia, at the end of last year, Deputy Finance Minister Sergei Storchak declared to the press: “Representatives of our tax service, the Central Bank, were there during the presentation of the cryptocurrency, which Venezuelans are now introducing. But no more than that. As for payments, there is nothing yet.” Which may be a fancy way to say no. In a previous report, the shoe was on the other foot, “Venezuela has not offered to repay part of its debts to Russia using the country’s cryptocurrency, Konstantin Vyshkovsky, head of the finance ministry’s state debt department, told reporters.”

As for the OPEC, the other huge client/ partner the Venezuelan government had in mind, a search on their website with “cryptocurrency” as a keyword just produces two reports from the same event in which they comment on Minister of Petroleum of Venezuela Manuel Quevedo Fernández’s participation by saying: “He pointed to the emergence of alternative forms of payments and said that “one of the innovative things [Venezuela] has done is to explore the creation of a new cryptocurrency.” Much work and research remains to be done in this regard, he noted.” -

2024-06-26 at 12:35 AM UTCWOZNY ALERT WOZNY ALERT

-

2024-06-26 at 1:17 AM UTCNow think about this, if Venezuela rejected their entire sanction evading crypto scheme which was partly developed by the Russians does that mean Venezuela has shifted towards a US economic alliance?

https://carnegieendowment.org/russia-eurasia/politika/2022/11/from-friend-to-competitor-how-russias-war-has-strengthened-venezuelas-handFrom Friend to Competitor: How Russia’s War Has Strengthened Venezuela’s Hand

Maduro will carry on pleasing Moscow with his talk of the fading hegemony of the West, all while restoring Venezuela’s economic ties with the United States. With no leverage to stop this rapprochement, the Kremlin will have no choice but to observe the developments from the sidelines.As Russia continues to wage war against Ukraine, its international influence suffers new setbacks. A thaw in U.S.-Venezuela relations is posing the greatest test this century of Moscow’s friendship with Caracas. After years of imposing sanctions against Venezuela, Washington is dropping ultimatums in favor of overtures, turning Venezuela’s disputed leader Nicolas Maduro into an unexpected beneficiary of events in distant Eastern Europe.

Of course, even with the recent U.S. decision to allow Chevron to resume oil production in Venezuela, Maduro’s regime will remain deeply anti-American, at least in its rhetoric. Yet that is no impediment to reaping the political and economic dividends of a fledgling rapprochement with the United States.

For Russia, Venezuela’s flirtation with the United States risks the loss of one of Moscow’s few unconditional supporters in the world. Maduro has repeatedly accused the West of escalating the Ukraine conflict with the aim of “dismembering” and “destroying” Russia. He condemns Western sanctions against Russia as “madness,” while dubbing the leadership of Ukraine a “neofascist elite.”

In the spring, Maduro phoned Putin to discuss “countering the West’s campaign of lies and disinformation.” In the summer, his deputy, vice president Delcy Rodríguez, spoke at the St. Petersburg International Economic Forum, where she declared that sanctions would “open new horizons for us.” In mid-December, a bilateral commission will meet in Caracas to consider just how wide those horizons are.

Russia and Venezuela’s ties may look flourishing, but there’s no cause for complacency on the part of the Kremlin, as the two countries’ cooperation is clearly past its prime. Just a few years ago, the Maduro regime was an international pariah, depending on Moscow’s assistance. The West refused to recognize Maduro’s victory in the 2018 presidential election citing massive fraud, while sanctions, mismanagement of the oil industry, and a fall in oil prices sent the country into an unprecedented socioeconomic crisis.

Many expected Maduro to fall, but his regime clung on, partly thanks to Russia’s support. Complex schemes for exporting Venezuelan oil to non-Western markets were devised to mitigate the risk of secondary sanctions, including the relocation of state oil company PDVSA’s European offices from Lisbon to Moscow: an example of what a U.S. official described in 2019 as the “greater reliance by PDVSA and Maduro’s regime on both the Russian government and [Russian state-controlled oil company] Rosneft.”

Rosneft was indeed one of the largest investors in Venezuela, entering into joint exploration and production projects with PDVSA. Yet in 2020, it announced that it would exit the country due to U.S. sanctions. Rosneft ultimately sold its Venezuelan assets to Roszarubezhneft, a Russian special purpose vehicle for circumventing sanctions, whose joint ventures in Venezuela produced 125,000 barrels of oil a day this spring.

Following the invasion of Ukraine, Maduro’s fortunes improved dramatically, thanks in large part to the West’s campaign to limit Russia’s oil revenues and the United States’ consequent need for alternative sources of oil. Maduro found himself meeting with U.S. climate envoy and ex-secretary of state John Kerry in Egypt and, more broadly, becoming a much more valuable partner for the United States.

For Washington, Venezuela is a viable alternative to Russia, because the refineries along the U.S. coast of the Gulf of Mexico are accustomed to the heavy crude oil, like Russian Urals or the one found in Venezuela. After a new round of the U.S. sanctions against Caracas in 2018, Russian deliveries supplanted those from Venezuela, accounting for 8 percent of U.S. oil imports as of 2021. Now, the opposite process appears to be under way.

In June, several months after a March visit by a U.S. delegation to Venezuela, Washington allowed Italy’s Eni and Spain’s Repsol to resume shipments of Venezuelan oil to Europe. In November, Chevron was granted a license to operate in Venezuela again. The company currently produces some 50,000 barrels a day, a number that could rise to 100,000 in the coming months.

Overall, the Venezuelan leadership is confident that it will restore the country’s oil revenues, with production reaching 1.2 million barrels a day in the next two to three years. Venezuela has the world’s largest proven oil reserves and used to produce 3.5 million barrels a day in 1998.

It will take seven to eight years and the investment of at least $250 billion in the modernization of equipment and development of new wells to return to the production levels of the late 1990s. Yet the money is out there, and now that the West has resolved not to return to business as usual with Russia, so is the political will.

A broader rapprochement between Venezuela and the United States is under way. In November, Mexico hosted new talks between the Venezuelan authorities and the opposition focused on unfreezing the country’s assets in Western banks.

Maduro is likely to seize the opportunity and allow the opposition to take part in elections slated for 2024 in the hope of getting security guarantees from the West and gradual lifting of sanctions, given that the risks for his regime are relatively low. The boon to the Venezuelan economy will accelerate its (ongoing) recovery, thanks to which Maduro may very well win new elections fair and square. It should help that in its fragmented state, the Venezuelan opposition does not currently pose a serious threat to the regime.

If things go sour in the run-up to the vote, Maduro will always be able to renege on his commitment to free and fair elections. After all, the consequences cannot be worse than what Venezuela has endured in recent years. In addition, the West will still have energy needs that cannot be met by Russia and so is unlikely to push for the complete reimposition of oil sanctions.

Maduro, then, will carry on pleasing Moscow with his talk of the fading hegemony of the West and the rise of multipolarity, all while restoring his country’s economic ties with the United States. With no leverage to stop this rapprochement, the Kremlin will have no choice but to observe the developments from the sidelines and reaffirm its readiness to “facilitate the preservation of a constructive atmosphere around the dialogue of Venezuelan political forces.”

https://www.coindesk.com/policy/2024/01/15/venezuela-ends-controversial-petro-cryptocurrency-reports/

https://www.barrons.com/news/venezuela-kills-off-petro-cryptocurrency-1e2b0317

https://www.ledgerinsights.com/russia-expects-cbdc-to-take-5-7-years-to-scale-starting-2025-earliest/Yesterday, the Governor of the Bank of Russia, Elvira Nabiullina, informed the State Duma about the progress of its central bank digital currency (CBDC) pilot, which started in August last year. As previously reported, the second wave of banks, including Russia’s largest bank Sber, is readying to join the digital ruble pilot.

Based on the results of the next wave, scaling will start, but not before 2025 at the earliest.

“We are asked the question: when will the digital ruble become a mass product?” said Nabiullina. “In our opinion, this will take five to seven years. This will be a natural process, because the choice of the people themselves and the business is fundamental; it should be convenient for them,” added Nabiullina according to the Parliamentary Gazette.

Targeting crypto for sanctions busting

During the same meeting, the central bank governor encouraged the use of cryptocurrencies for foreign settlement. RIA Novosti reported that the governor wants a sandbox-type setup. Nabiullina is staunchly against promoting cryptocurrencies domestically.

“Here we need to try in experimental mode for foreign economic international payments… We have long agreed to use digital currencies for foreign economic settlements… It seems to me that it would be desirable for us to quickly adopt this regime, work it out, see what is possible. And to introduce general legislation,” she said at a joint meeting of State Duma committees.”

Previously Russia had planned to use regulated digital financial assets (DFA) such as tokenized gold for sanction-busting payments. Domestically DFAs do not serve as payment instruments, but Russia recently passed legislation allowing them for cross border payments. The United States OFAC stepped in and extended its sanctions list to cover the first five licensed DFA platforms.

However, the OFAC list also included some crypto platforms used for offshore payments, including Rosbank partner B-Crypto.

With the current state of sanctions, the usage of the Chinese yuan continues to grow in Russia. According to the latest Russian central bank report, the yuan made up 53% of the foreign exchange market on exchanges and 39.6% over the counter (OTC).

Venezuela was the test run, The concept is proven to work and I except the Russian CBDC will operate in a similar manner and take over society. And people in Russia support this shit? I mean I guess it's not a #Woke western hebrews running the banks but the idea of a nation state having such deep control of a unit of exchange itself is pretty hecking spooky to me. Needing to show ID to use money lol

-

2024-06-26 at 1:28 AM UTCThe following users say it would be alright if the author of this post didn't die in a fire!