User Controls

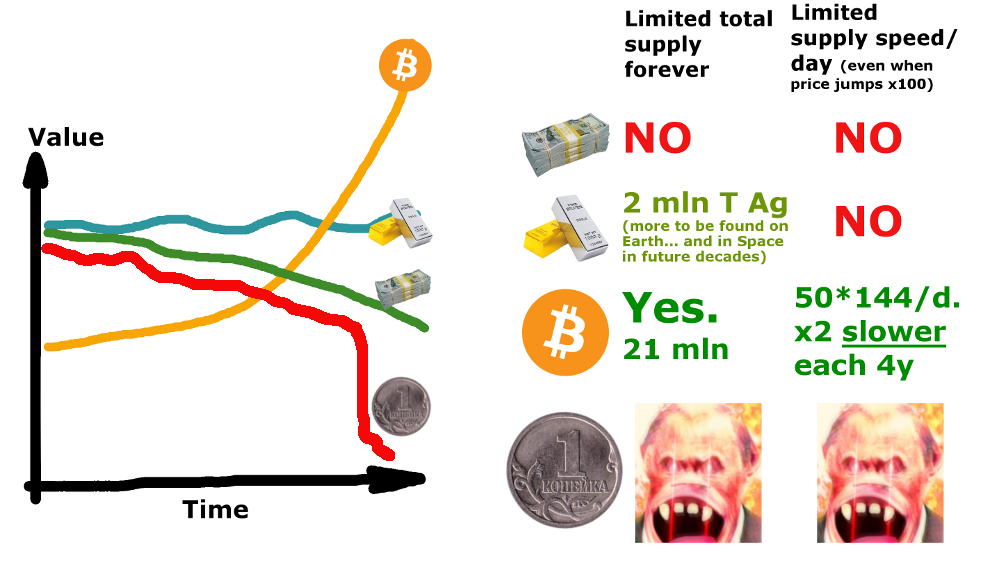

The Dollar is going to crash and Americans are going to be poor

-

2022-04-20 at 2:15 PM UTCwhat i need is plumbum.

-

2022-04-20 at 2:39 PM UTC

-

2022-04-20 at 2:43 PM UTC

-

2022-04-20 at 2:45 PM UTC

-

2022-04-20 at 2:46 PM UTC

-

2022-04-20 at 3 PM UTC

-

2022-04-20 at 3:11 PM UTCThey will throw their silver into the streets, and their gold will become abhorrent to them. Neither their silver nor their gold will be able to save them in the day of Jehovah’s fury. They will not be satisfied, nor will they fill their stomachs, for it has become a stumbling block causing their error. - Ezekiel 7:19

-

2022-04-20 at 3:16 PM UTC

-

2022-04-20 at 3:26 PM UTC

-

2022-04-20 at 3:38 PM UTC

Originally posted by the man who put it in my hood NO actually in the year of 2012 you could buy 1 oz of gold with 120 BTC and nowadays you could buy several kilograms of gold for that much

nope.

the price-value of gold remains fairy consistent. its the price-value of your fantasy money that has shot up. -

2022-04-21 at 1:43 PM UTC

-

2022-04-21 at 1:47 PM UTC

-

2022-04-21 at 1:52 PM UTC

Originally posted by vindicktive vinny nope.

the price-value of gold remains fairy consistent. its the price-value of your fantasy money that has shot up.

yes hence the pair BTC/GOLD favors the BTC you idiot did you even see the picture?

Would you rather invest in something consistent or something that goes MOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOON -

2022-04-21 at 2:03 PM UTC

-

2022-04-21 at 3:35 PM UTC

-

2022-04-21 at 3:38 PM UTC

Originally posted by the man who put it in my hood yes hence the pair BTC/GOLD favors the BTC you idiot did you even see the picture?

Would you rather invest in something consistent or something that goes MOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOON

id rather invest in plumbum so that people would pay me their platinum and gold in order for me to not exchange my prescious plumbum with them. -

2022-04-21 at 3:44 PM UTCBTC/PLUMBUM is basically just one giant red candle

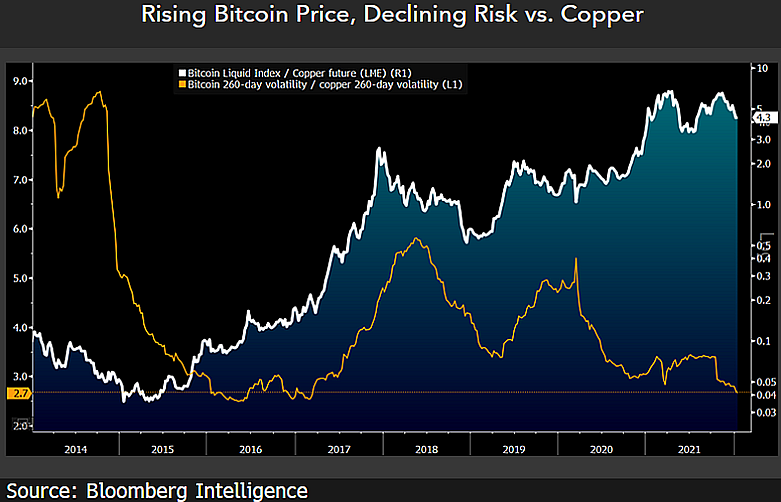

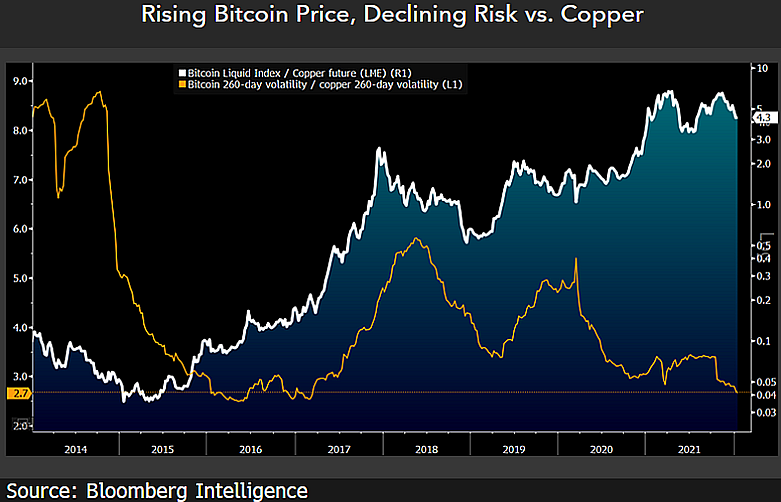

Mike McGlone, a senior commodity strategist at Bloomberg Intelligence, has suggested that commodities are unlikely to witness a price supercycle if Bitcoin’s growth and maturity is anything to go by.

The strategist has previously predicted that Bitcoin’s price could rally to $100,000 this year, and he’s not convinced of a similar run for commodities.

According to McGlone, the market resilience of Bitcoin and the outlook for metals like copper suggest the potential for a mega uptick for commodities is low. He indicated this in a comment shared on Twitter on Thursday, 13 January.

He noted that Bitcoin has the “edge” over copper, referring to the comparison between digital gold versus “the Old-Guard Doctor.”

Looking at a chart comparing Bitcoin’s rising price and declining risk versus copper futures, and the 260-day volatility for both assets, McGlone noted:

Chart showing Bitcoin vs. copper price and volatility comparison. Source: Mike McGlone on Twitter

“Copper may be a good example of the low potential for a commodity supercycle, notably vs. an advancing Bitcoin. We see Bitcoins’ upper hand gaining endurance, and maturity, vs. copper.”

-

2022-04-21 at 3:48 PM UTC

-

2022-04-21 at 3:52 PM UTC

Originally posted by the man who put it in my hood BTC/PLUMBUM is basically just one giant red candle

your fantasy coins are retarded and theres technically no ceiling it could ever hit as long as institutional ''investors'' that get their money supply from the fed reserves printer are allowed to ''invest'' in bitcoins.

what this means is bitcoins will be just as worthless as fiat monies are as long as worthless fiat monies can be exchange for it.

anything of value X something worthless = wholething worthless. -

2022-04-21 at 3:54 PM UTC

Originally posted by vindicktive vinny your fantasy coins are retarded and theres technically no ceiling it could ever hit as long as institutional ''investors'' that get their money supply from the fed reserves printer are allowed to ''invest'' in bitcoins.

what this means is bitcoins will be just as worthless as fiat monies are as long as worthless fiat monies can be exchange for it.

anything of value X something worthless = wholething worthless.

you're too stupid to understand how halvening cycles or proof of work vs proof of stake work. When there is less of a supply of something it becomes worth more, simple economics. You can make 99999 quadrillion dollars but there is a fixed supply of bitcoins.